STRATEGY DEVELOPMENT

Joseph Schumpeter, the Austrian economist, and several modern management theorists inspired by his work, see a world where good companies do not just appropriate value at the expense of others, they progress by continuously creating new value out of the existing endowment of resources.

This notion of ‘creating value’ lies at the heart of Gattorna Alignment’s strategy development work with clients. We believe there are ways to improve and sustain performance by returning to the fundamentals of what different customers value and how and where our organisations create value.

We have developed and collected a range of tools and techniques to simplify and condense strategy to its fundamentals.

We also recognise the critical importance of organisational culture in delivering strategy; and the absolutely fundamental role that leadership plays in shaping appropriate cultures and keeping the business in touch with its market. We help clients to identify the cultures and leadership styles that are needed to drive value in different situations.

MARKET RESEARCH

Modern companies are over servicing some customers and underservicing others; but for the most part they don’t know which is which.

- Dr John Gattorna at the Supply Chain Business Forum in Melbourne.

In the process of seeking to gain competitive advantage in a globalised world, organisations are starting to appreciate the importance of understanding their customers more deeply.

Very often, however, this is marketing driven and aspects of the brand or ideas for the next product innovation is the focus of the customer spotlight.

There is a critical need to also understand how customers engage with the organisation more generally, and what they really want from the operation specifically. When it comes down to gleaning insights that inform operational strategies, most research fall short.

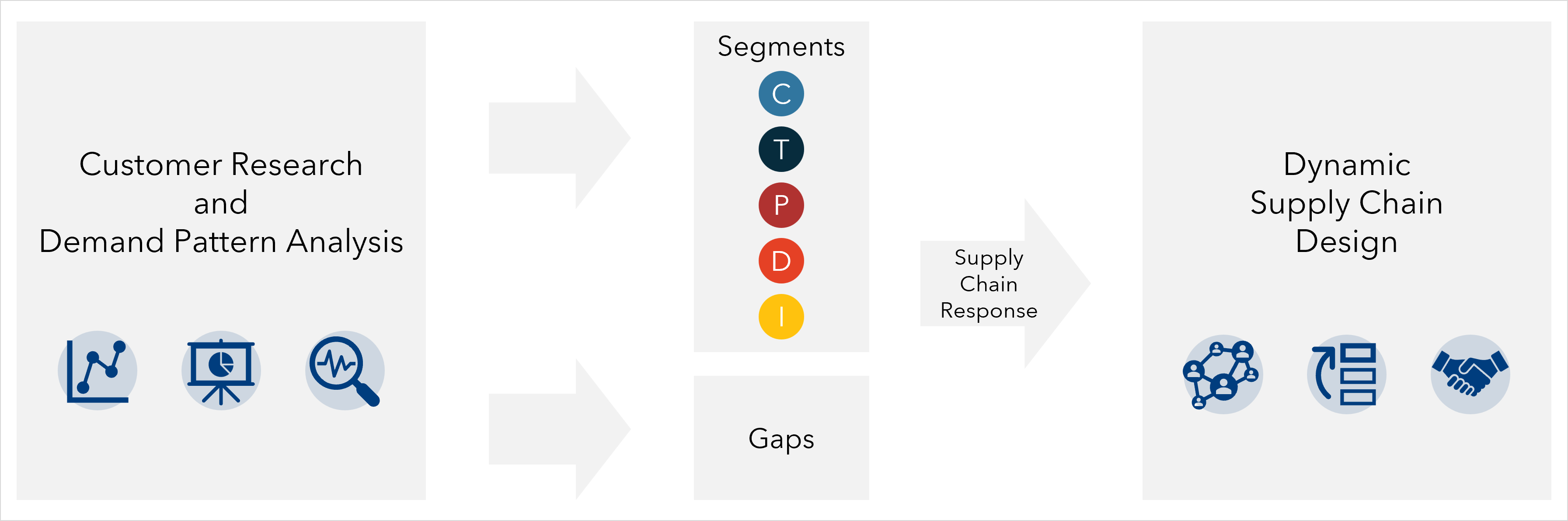

At Gattorna Alignment we advocate broad-based Market Research that builds a profile of different customers’ expectations and drivers, while also capturing their pragmatic service needs. We leverage the Dynamic Alignment™ framework to create insight, while reducing complexity.

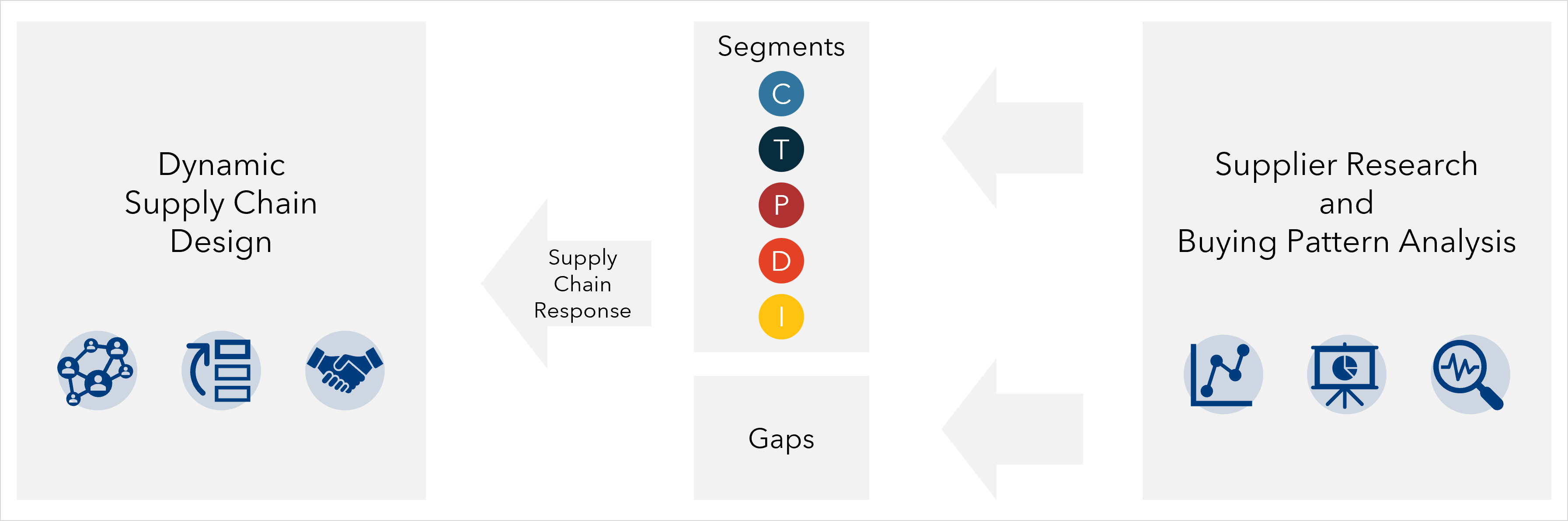

On the other end of the value chain, we recognise that suppliers are a critical determinant of what we can and cannot achieve in the market. We also propose that their needs, expectations, strengths and limitations are under-acknowledged and the impact that they can have on strategy is under-estimated. For this reason, we believe there is often a strong case for conducting Supplier Research to profile, and provide clarity around, upstream value opportunities.

Customer Research

We conduct selective and systematic research with a structured sample of customers, or where appropriate, with the full customer base. Our segmentation techniques have been developed in conjunction with leading universities. Our research partners provide multi-lingual capabilities to enable global studies. The results are useful for supply chain strategy design, but also have much wider application across the business.

Supplier Research

In many ways, the supply-side of the value chain is a mirror image of the demand-side. Suppliers have different needs and capabilities, and segmentation is equally valid to create clarity and definition around the value they bring and what they need from a procurement relationship. The methodologies that we have developed to support Customer Research, have also been successfully applied to suppliers.

DEMAND & SUPPLY PATTERNS

When the doctor orders a blood test, the results give him insight into multiple aspects of your overall health. The same occurs with a detailed analysis of a client’s sales data.

For many years data was only used for monitoring last months’ results to see if the organisation was on track. With contemporary software, we can collect years of data and analyse different aspects of the demand patterns over time and then link these to customer behaviour. This can provide insights into their own operation, their preference for doing business and also into the constraints our organisation has imposed on them. Ideally this can also be linked to the more qualitative results from Market Research.

In some industries, supply is the key dynamic that needs to be understood before even looking to the market. In agriculture, mining and capital intense industries the patterns of supply define and set the pace for what can be offered to customers. In these situations, particularly, supply data is analysed to assess patterns and probabilities, and to help us understand the role the supply chain needs to play in decoupling supply and demand. These patterns can also be tied back to Supplier Research to identify how supply behaviour and performance is linked.

NETWORK MODELLING

… and advanced decision support to design and operate aligned supply chains.

Gattorna Alignment leads projects that help our clients bring sophisticated decision support to the supply chain and the extended enterprise.

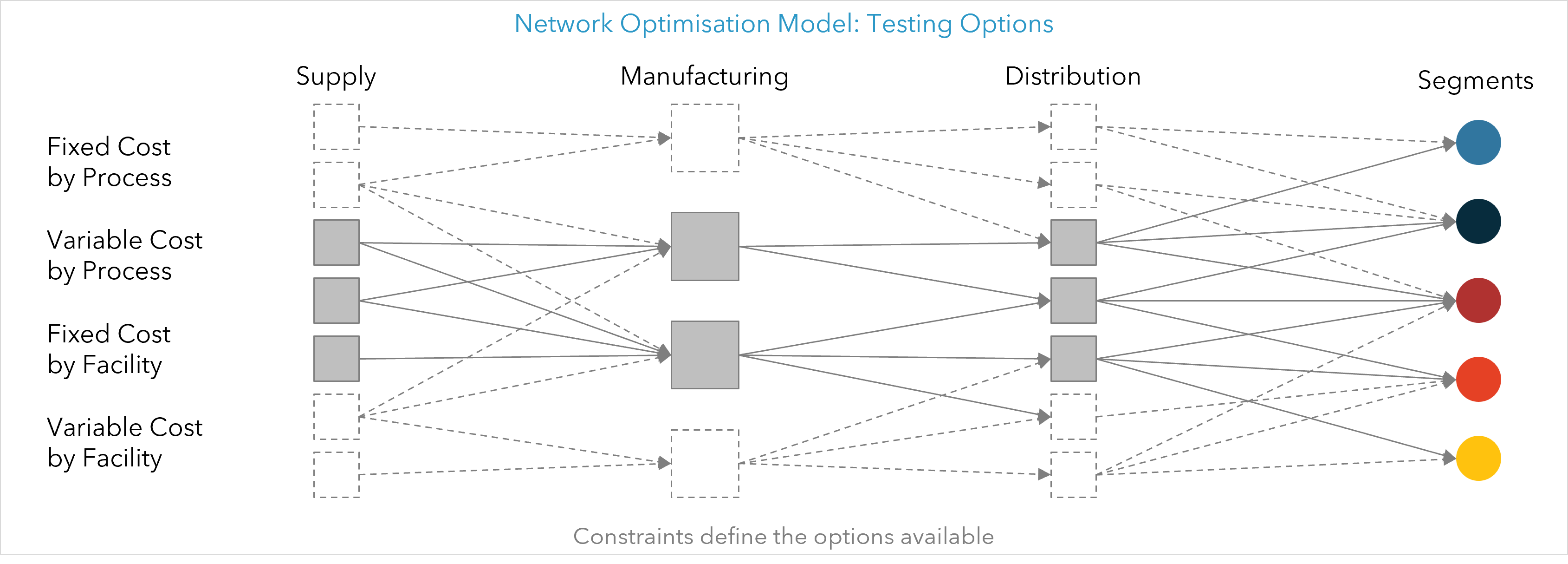

Many experts consider that 80% of the costs of the supply chain are locked in by the manufacturing and distribution facility location decisions and the flows between them. Similarly, much of the service capability is defined by these locations. Network design is thus one of the most potent weapons for quantum improvements in either cost or service.

Network modelling is also a highly effective tool to more closely connect the supply chain to the market, and developing new methods to improve alignment via network design has been the focus of Gattorna Alignment’s involvement in strategic modelling in recent years.

Gattorna Alignment’s partners John Gattorna and Deborah Ellis were pioneers in the use of network modelling to support strategic supply chain network decisions, working with professors from MIT on projects in Australia, New Zealand and Indonesia from the late eighties.

Today, sophisticated decision support can also be used at the tactical and operational level. The concept of ‘design’, however, is still relevant, and our role has expanded to assist our clients to ensure they are automating for the right outcomes.

ALIGNED DIGITISATION

We are quickly moving into a data-rich era. Without a digital strategy, the benefits of this era will pass us by, or we will drown in the complexity that it generates.

The combination of initiatives moving into the mainstream, including: optimisation and AI to guide, and in some cases automate, operational and tactical decisions; IOT to support visibility; and blockchain in the service of security and provenance offer enormous opportunity. But organisations will need a clear strategy that links data and decisions to customer value (the ultimate test).

Gattorna Alignment have been focusing on both the strategy question, and the organisational questions around pursuing digitisation, and believe there is an orderly way to address both.

LABORATORY

… we are continually refining our existing techniques, as well as developing new techniques using the world of business as our laboratory.

At Gattorna Alignment we work with both an academic mindset and a business driven pragmatism. We use research and analytics to search out new truths, and then work with our clients to convert these into competitive advantage.

As in laboratories we mix and match, we test and reconfigure, all in close conjunction with our client team. Modelling, customer inputs and data lead us towards new insights and new solutions.

With over 30 years of cross-industry business experience, we continuously study the patterns and the practice, and seek to develop new ways to reduce complexity and keep ahead in a fast-changing world. Our clients rely on it!